반응형

Economy

바이낸스 선물/마진거래 퀴즈 정답

2021.12

바이낸스 로그인 후 Trade > Margin 메뉴를 클릭

Start the Quiz를 클릭

총 12문항

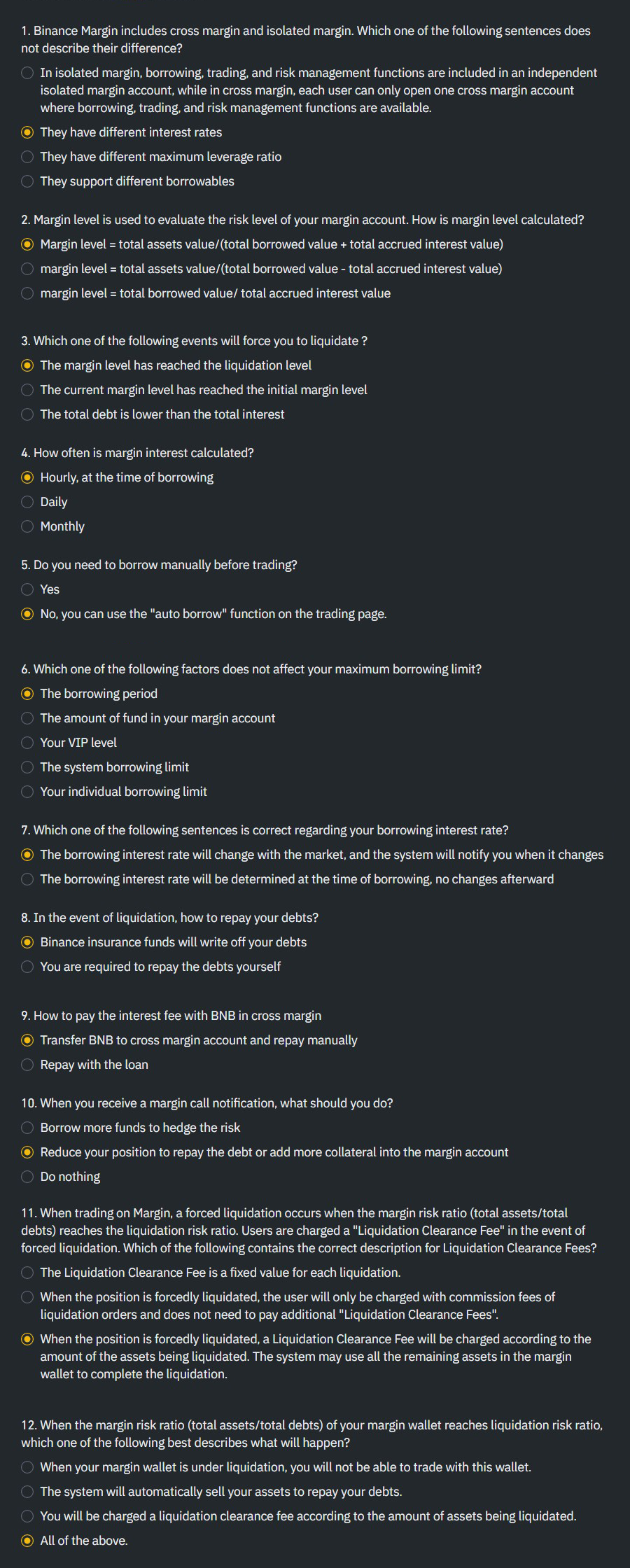

정답 : 2,1,1,1,2,1,1,1,2,2,3,4

(정답은 순서나 내용이 바뀔 수 있으니 아래 사진을 참고해주세요)

1. Binance Margin includes cross margin and isolated margin. Which one of the following sentences does not describe their difference?

○ In isolated margin, borrowing, trading, and risk management functions are included in an independent isolated margin account, while in cross margin, each user can only open one cross margin account where borrowing, trading, and risk management functions are available.

● They have different interest rates

○ They have different maximum leverage ratio

○ They support different borrowables

2. Margin level is used to evaluate the risk level of your margin account. How is margin level calculated?

● Margin level = total assets value/(total borrowed value + total accrued interest value)

○ margin level = total assets value/(total borrowed value - total accrued interest value)

○ margin level = total borrowed value/ total accrued interest value

3. Which one of the following events will force you to liquidate ?

● The margin level has reached the liquidation level

○ The current margin level has reached the initial margin level

○ The total debt is lower than the total interest

4. How often is margin interest calculated?

● Hourly, at the time of borrowing

○ Daily

○ Monthly

5. Do you need to borrow manually before trading?

○ Yes

● No, you can use the "auto borrow" function on the trading page.

6. Which one of the following factors does not affect your maximum borrowing limit?

● The borrowing period

○ The amount of fund in your margin account

○ Your VIP level

○ The system borrowing limit

○ Your individual borrowing limit

7. Which one of the following sentences is correct regarding your borrowing interest rate?

● The borrowing interest rate will change with the market, and the system will notify you when it changes

○ The borrowing interest rate will be determined at the time of borrowing, no changes afterward

8. In the event of liquidation, how to repay your debts?

● Binance insurance funds will write off your debts

○ You are required to repay the debts yourself

9. How to pay the interest fee with BNB in cross margin

● Transfer BNB to cross margin account and repay manually

○ Repay with the loan

10. When you receive a margin call notification, what should you do?

○ Borrow more funds to hedge the risk

● Reduce your position to repay the debt or add more collateral into the margin account

○ Do nothing

11. When trading on Margin, a forced liquidation occurs when the margin risk ratio (total assets/total debts) reaches ○ the liquidation risk ratio. Users are charged a "Liquidation Clearance Fee" in the event of forced liquidation. Which of the following contains the correct description for Liquidation Clearance Fees?

○ The Liquidation Clearance Fee is a fixed value for each liquidation.

● When the position is forcedly liquidated, the user will only be charged with commission fees of liquidation orders and does not need to pay additional "Liquidation Clearance Fees".

When the position is forcedly liquidated, a Liquidation Clearance Fee will be charged according to the amount of the assets being liquidated. The system may use all the remaining assets in the margin wallet to complete the liquidation.

12. When the margin risk ratio (total assets/total debts) of your margin wallet reaches liquidation risk ratio, which one of the following best describes what will happen?

○ When your margin wallet is under liquidation, you will not be able to trade with this wallet.

○ The system will automatically sell your assets to repay your debts.

○ You will be charged a liquidation clearance fee according to the amount of assets being liquidated.

● All of the above.

반응형

'경제 Economy' 카테고리의 다른 글

| [경제] 더크립토유 - 100만원 투자로 일 15만원 수익을 얻는 게임이 있다? #P2E게임 #부업 (0) | 2021.12.07 |

|---|---|

| [경제] 덱사타 "무돌코인" 시세 보는 곳 - 무한돌파삼국지코인, 클레이스왑 코인 12/09업데이트 내용 추가 (1) | 2021.12.06 |

| [경제] 꼭 챙겨봐야 할 코인 유튜브채널 - 포트폴리오, 유망코인 (0) | 2021.12.03 |

| [경제] 카르다노 ADA 비트스탬프 상장 및 거래 시작! (0) | 2021.11.24 |

| 코인관련 중요사이트 모음 - 시가총액, 차트, 코인거래소 순위 볼 수 있는 사이트, 김치프리미엄 등 (0) | 2021.11.18 |